Dubai Apartment Investment: Advantages and Price Ranges

Dubai, one of the fastest-growing cities in the world, offers attractive opportunities for real estate investors. Most importantly, there is no annual income tax, rental tax, or capital gains tax in the Emirate. These tax advantages

Read More

Advantages of Real Estate Investment in Dubai

Real estate investment in Dubai offers the following key advantages:

- Tax Benefits: There is no annual property tax or rental income tax in Dubai. Additionally, no capital gains tax is levied on property sales. Therefore, investors can retain all income from rentals and sales in their portfolio.

- High Rental Yields and Growing Economy: As an international business and tourism hub, Dubai has strong housing demand. In recent years, rental yields have reached around 5–10% annually. The rapidly growing population and increasing number of tourists support rental returns and improve investment profitability.

- Residency Opportunities: Property investments of a certain amount grant residency rights to foreign investors. Especially properties valued at ~750,000 AED or more offer a 2-year residency visa, while those above 2 million AED offer a 10-year visa. Thus, investors can obtain long-term residency in Dubai through real estate ownership.

- Strategic Location and Stability: Dubai’s geographical proximity to Turkey and other countries, advanced security, and free-market policies make it more resilient to global crises. Additionally, the UAE’s double taxation agreements with many countries provide extra advantages for international investors.

Apartment Price Ranges in Dubai

Apartment prices in Dubai vary significantly based on location, size, and quality. Generally, mid-range apartments range from 700,000 to 2,000,000 AED, while luxury segment properties are priced much higher. Based on recent sales data:

- Mid-range: In developing areas such as Jumeirah Village Circle (~874,000 AED), Arjan (~905,000 AED), and Meydan One (~717,000 AED), average apartment prices are generally around 700,000–900,000 AED.

- Central areas: In prime locations such as Business Bay (~1,600,000 AED) and Dubai Marina (~2,000,000 AED), similar-sized apartments are typically priced between 1.5–2 million AED.

- Luxury segment: The average sale price in Downtown Dubai is around 2.8 million AED. In ultra-luxury areas like Palm Jumeirah, prices are significantly higher; for instance, 2-bedroom apartments in Anantara Residences are priced at ~4.3 million AED, while larger units can reach tens of millions.

Top Areas for Investment

Freehold zones in Dubai, where foreign ownership is permitted, are particularly attractive for investors. These include:

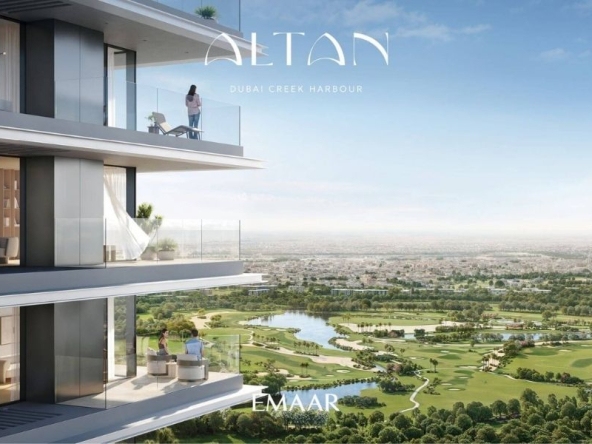

Downtown Dubai

Downtown Dubai is a prestigious district known for iconic landmarks such as Burj Khalifa and Dubai Mall. It attracts global investors and high-income tenants. Its central location, luxury lifestyle, and heavy business traffic ensure strong rental demand. Studies show that securing tenants for premium apartments here is relatively easy, which supports rental yields.

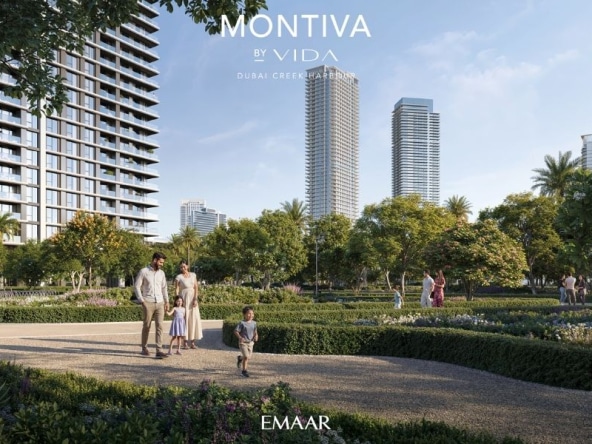

Dubai Marina

Dubai Marina is a waterfront community known for its high-rise towers and marina views. The area features luxurious residential projects open to foreign investors. Average rental yields here are around 5–7%. Additionally, there is strong demand for short-term holiday rentals, offering investors flexible income opportunities. Its world-class infrastructure and amenities make it a reliable investment destination.

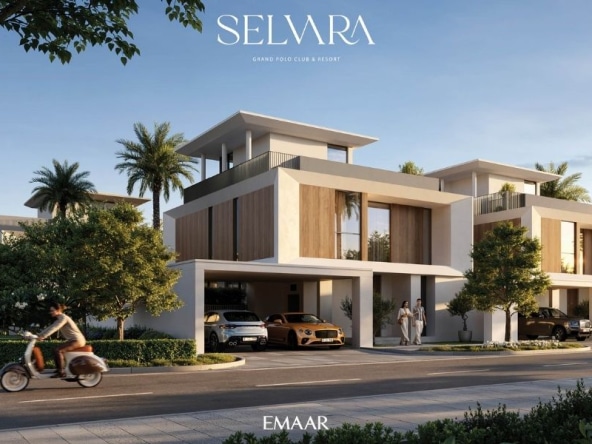

Palm Jumeirah

Palm Jumeirah is a man-made island filled with luxury residences and resorts. It’s also part of the freehold zone where foreigners can own property. Sea-view apartments and villas are prominent here. In ultra-luxury projects like Anantara Residences, 2-bedroom apartments are priced around 4.3 million AED. Thanks to its architecture and prestige, Palm Jumeirah remains a highly desirable location for investors.

Property Ownership Process and Legal Notes for Foreigners

Foreign investors in Dubai can only buy property in designated freehold areas. The buying process generally includes the following steps:

- Location and Title Verification: Ensure the selected property is clean on the Dubai Land Department (DLD) database and the developer has a reliable track record.

- Signing the Memorandum of Understanding (MoU): The buyer and seller sign a preliminary agreement outlining the sale conditions. At this stage, a deposit of around 10% of the property value is typically paid.

- Title Deed Registration: After the deposit is made, both parties meet at the DLD office to finalize the transfer. A 4% fee on the sale price is paid, and the title deed is officially registered under the buyer’s name.

- Additional Costs: The process may also involve documentation/admin fees and developer approval (NOC) charges. If a real estate agent is used, a 2–3% commission is typically paid. Post-purchase expenses include annual service charges and property insurance.

Frequently Asked Questions

- Can I get residency through investment? Yes. Properties valued at around 750,000 AED or more qualify for a 2-year visa, while investments over 2 million AED qualify for a 10-year residency visa. This enables investors and their families to reside in Dubai long term.

- What should I consider when buying an apartment? First, verify that the property is in a freehold area and confirm its status through the Dubai Land Department. Key considerations include the developer’s credibility, payment plan, annual service charges, and delivery timeline. All title and project details can be verified on the DLD portal.

How does the title deed process work? After signing the MoU, the buyer and seller visit the Dubai Land Department to complete the official transfer. Typically, the buyer pays a 4% fee on the sale price. Once the registration is complete, the property is officially transferred to the new owner.